Personal debt consolidation and credit card refinancing require using a new loan to pay back your current harmony. This doesn't get rid of credit card debt, but replaces just one debt with One more. Although particular loan fees frequently are reduce than charge card fascination costs, you could possibly pay back much more in origination expenses and desire in excess of the life of the loan according to other loan conditions. Make sure you seek advice from a fiscal advisor to determine if refinancing or consolidating is ideal for you.

These disclosures will element when a difficult pull may well happen, in conjunction with other terms and conditions of your chosen Company's and/or top lender's services.

Best IRA accountsBest on the web brokers for tradingBest on-line brokers for beginnersBest robo-advisorsBest selections trading brokers and platformsBest buying and selling platforms for day trading

Autopay lenders offer a range of automobile loans, including loans for new and used autos bought from the dealership, private-get together loans, and refinancing options which include traditional, dollars back again and lease buyout loans.

Nonetheless, having a private loan could possibly be challenging should you aren’t aware of lenders’ prerequisites or don’t fully grasp the appliance procedure. It is possible to normally receive a $sixty,000 particular loan from banking institutions, credit score unions or on the web lenders, but in the end, whether you may get this quantity will rely on your credit history history. If you don’t have a strong economic record, you may not be qualified for this loan sum.

For those who engage in a lending circle with spouse and children or mates, which can be the same approach to borrow more info income rapidly. Which has a lending circle, collaborating users pool their income collectively and loan a established amount of money out to each member on a rolling foundation.

Promote your present auto to Carvana using a organization present in as little as 2 minutes and add it in your invest in as a trade-in.

As outlined, lenders consider the house’s LTV ratio when placing property loan prices. The greater you place towards your down payment, the reduce your LTV, which subsequently lowers your desire price. Aiming for twenty% may help you save you money on the price of private mortgage insurance coverage.

Loans can be found in lots of types and they are utilized for various functions. Have an concept of what kind of loan is good for you before you use.

Why MyAutoLoan stands out: Some lenders within the MyAutoLoan network supply fees as low as 6.eighty four% in case you qualify. MyAutoLoan will make purchasing about for the vehicle loan quick — immediately after submitting the prequalification software, you could potentially acquire as many as 4 loan presents.

Include things like service fees inside your comparison: Some lenders charge fees for loan origination, prepayment or late payments. Even though these may seem minimal at enough time, they could include up above the everyday living within your loan.

Your lending circle may have a specific buy to how it distributes payouts to individuals, but that could transform if you have an urgent have to have for The cash.

Your credit score score will considerably affect your eligibility for any $sixty,000 particular loan. Should your credit rating rating is weak and also you aren’t actively using steps to further improve it, you might rethink implementing for a private loan.

HELOC A HELOC is a variable-charge line of credit score that allows you to borrow money for the established time period and repay them later on.

Kel Mitchell Then & Now!

Kel Mitchell Then & Now! Ben Savage Then & Now!

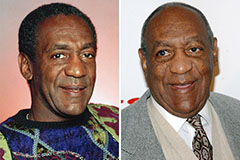

Ben Savage Then & Now! Bill Cosby Then & Now!

Bill Cosby Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now! Christy Canyon Then & Now!

Christy Canyon Then & Now!